NEW DELHI: NTPC will focus on gigawatt (GW)-scale solar power projects and limit wind and battery storage projects to 10% of its renewable portfolio as the country’s largest coal-fired power producer chases a green dream of adding 60 GW green capacity by 2035.

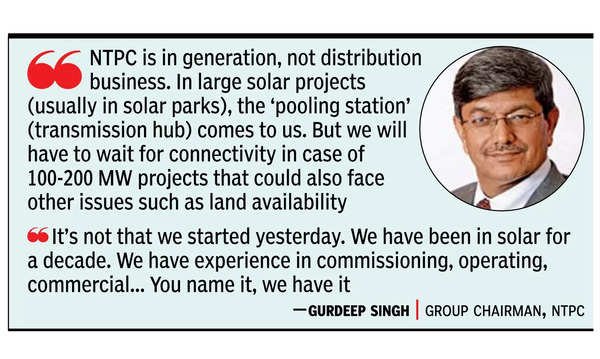

“NTPC is in generation, not distribution business. In large solar projects (usually in solar parks) the ‘pooling station’ (transmission hub) comes to us (set up on site by park promoters or utilities). But we will have to wait for connectivity in case of 100-200 MW projects that could also face other issues such as land,” group chairman Gurdeep Singh said after the Rs 10,000-crore IPO of subsidiary NTPC Green Energy opened on Wednesday.

He said NTPC has developed capabilities in all areas of the renewables and enjoys certain advantages. “It’s not that we started yesterday. We have been in solar for a decade. We have the experience in commissioning, operating, commercial… You name it, we have it,” he said.

The company is following a clear road map for renewables that gleans lessons from the past and funding plans backed up the flagship’s record. The focus on solar, however, does not come at the cost of other sustainable energy sources.

“Solar is available 340-350 days across India, whereas wind is periodic – except one or two locations. So someone with wind (project) in the south and solar in Rajasthan can do mix-and-match (with smaller projects). We will certainly go into wind or add battery storage wherever we find attractive. We are also pursuing nuclear and green hydrogen separately,” he said.

NTPC aims to ramp up renewable capacity to 19 GW by 2027 after nearly doubling the present capacity of 3.5 GW to 6 GW by 2025 on way to the 60-GW mark. Singh said NTPC is well-equipped to weathering possible market shifts due to tighter import policy for solar cells or external factor such as an expected dilution in the US focus on renewables under Donald Trump’s second presidency.

“The impact of duty on solar cell imports, if it comes, will be minimal on projects. As for shift in US policy, I am told some made in India solar modules are exported. We will have to see (how things pan out). There is Europe, other regions…” he said.

On IPO pricing being “punchy” amid the market slide following Trump’s election, Singh said it’s based on misplaced notion. “We had consulted with 100s of stakeholders and investors, who expected a higher price band, which we moderated as per (post-Trump) market conditions.”