Pakistan’s energy sector isn’t broken by chance. It’s broken by design

Last year, Pakistan found itself in the absurd position of paying penalties to avoid receiving liquefied natural gas (LNG) cargoes it had contractually committed to buy.

The country, structurally dependent on imported energy, was negotiating to divert dozens of scheduled shipments because domestic demand had collapsed. When resale arrangements were struck, downside risks stayed with Islamabad while upside gains went elsewhere.

This wasn’t bad luck. It was the inevitable outcome of rigid contracts signed without adequate demand modelling or currency risk management. And it’s the same story, repeated across fuels and technologies, for three decades.

Price can’t fix institutional incompetence

Pakistan’s energy debate usually settles on two explanations for persistent dysfunction: external shocks (fuel prices, exchange rates, floods) or outright theft and corruption. Both contain truth. Neither explains why identical structural problems occur regardless of who’s in power or which fuel is being discussed.

The real answer is institutional incompetence, not as an insult, but as a diagnosis.

Consider the generation capacity mess. Pakistan now has over 46,000MW of installed capacity. Peak demand rarely exceeds 30,000MW. Off-peak? It can drop below 10,000MW. Utilisation hovers around 35 per cent.

Yet we pay nearly Rs1.9 trillion annually in capacity payments.

These aren’t numbers that emerge from technical miscalculations. They reflect a negotiation framework that guaranteed dollar-indexed returns, backed by sovereign guarantees, without sufficiently robust demand forecasting or hedging mechanisms. When demand growth slowed and the rupee weakened, the fixed obligations remained. Consumers absorbed the cost.

This is what happens when planning proceeds in isolation from macroeconomic reality. The mismatch is structural.

Circular debt is often framed as a financial problem requiring financial solutions. The government periodically announces settlement packages backed by guarantees and bank borrowing to clear arrears and stabilise liquidity.

These don’t work. The debt currently sits between Rs1.6 and 2.6 trillion, depending on how you measure it, and continues to climb because the underlying behaviours haven’t changed.

Distribution companies recently posted quarterly losses exceeding Rs170 billion, split between technical inefficiencies, outright theft, and weak recoveries. Tariff adjustments get delayed for political reasons. Performance enforcement remains inconsistent.

Financial restructuring without governance reform just shifts obligations around. The interest keeps compounding. The arrears regenerate.

The solar net-metering episode tells you everything about reactive governance. When electricity tariffs spiked and supply became unreliable, rooftop solar installations surged. Households and businesses did exactly what economics textbooks predict: they responded to price signals.

The policy response was to slash buyback rates (in some cases from Rs26 per unit to Rs11 per unit) to protect distribution company revenues.

A confident system would’ve welcomed distributed generation as part of the energy transition. It would’ve prioritised reducing line losses (which remain staggering), modernising billing, and improving enforcement before recalibrating incentives.

Instead, we got an abrupt reversal. And abrupt reversals introduce uncertainty, which raises financing costs in an economy already starved for capital.

Here’s the core problem: every actor in Pakistan’s energy system responds rationally to perverse incentives, and the sum of those rational responses produces a crisis.

Generators get guaranteed returns whether they’re dispatched or not. Distribution companies operate under weak enforcement. Governments manage tariffs through political timing rather than cost recovery. Consumers, facing high prices and unreliable service, lose trust and compliance deteriorates. Regulators function with constrained autonomy.

No villain required. Just misaligned incentives, compounded over decades.

This explains why the crisis persists despite sharp increases in tariffs. Price alone can’t stabilise a system where the institutional architecture rewards the wrong behaviours.

Authority over energy policy is scattered across multiple ministries, divisions, and regulators with overlapping mandates. Tariff decisions remain politically sensitive. Subsidy commitments get delayed in fiscal transfers. External reform frameworks, often attached to International Monetary Fund (IMF) programmes, may push adjustments, but without internal ownership, reform becomes episodic rather than embedded.

Meanwhile, heavy dependence on imported fuels leaves Pakistan exposed to exchange-rate shocks, yet foreign-exchange risk management remains peripheral to planning. At the same time, domestic resources (hydropower, wind, solar) haven’t been integrated into a coherent diversification strategy.

The energy crisis is not technical; it’s political

The country has generational assets, infrastructure, and technical talent. What it lacks is the institutional capacity to align planning, contracts, regulation, enforcement, and fiscal discipline with economic reality.

Fixing this doesn’t necessitate a miracle. It requires boring, politically costly, incremental work.

Integrated planning that links gas and power decisions to realistic demand forecasts, updated regularly. Procurement frameworks that value flexibility and explicitly hedge currency risk. Distribution reforms centred on enforceable performance standards and metering integrity. Regulatory autonomy that allows timely, depoliticised tariff adjustments. Transparent subsidy accounting so arrears don’t masquerade as policy.

Without institutional redesign, every financial injection and contract renegotiation will remain a temporary patch on a structurally fragile system. Pakistan doesn’t need another bailout package or another circular debt settlement. It needs institutions that function.

The energy crisis, at its core, is a governance failure: persistent, predictable, and entirely fixable if there’s political will to prioritise long-term functionality over short-term optics.

Until then, we’ll keep signing contracts we can’t honour, building capacity we can’t use, and wondering why the lights keep going out.

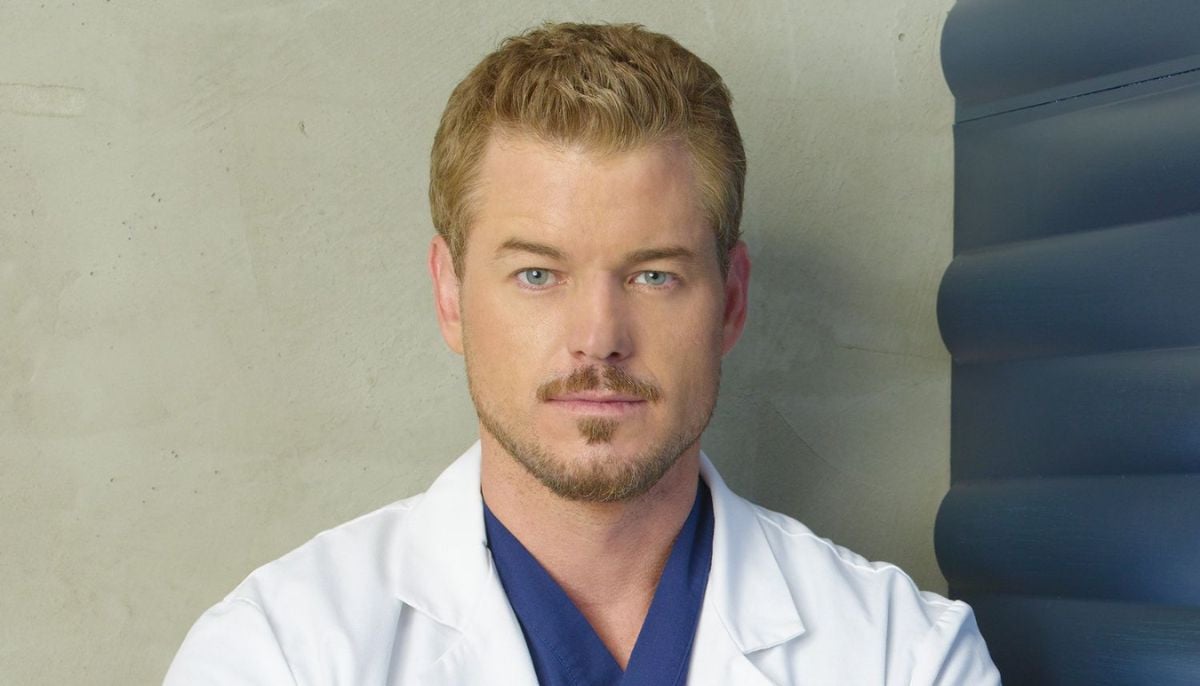

Header image: Steam rises from a conventional power plant, emblematic of an energy system shaped by costly contracts and structural inefficiencies. Photo credit: Andrew Kerr/WWF.